Frequently Asked Questions

Below you will find the answers to many commonly asked questions at Silver.com. Click any of the + buttons to expand a section of answers.

- General

- Payments

- Pricing

- Returns

- Shipping

- Ordering

- Products

- Reporting & Tax

- Precious Metals IRA

- Terminology

- Coin Grades

Who is Silver.com?

Silver.com is one of the premier destinations for investing in physical silver and gold bullion, as well as other precious metals products. Our company allows savvy and self-directed investors to purchase precious metals and have them delivered directly to their door. To see what others are saying about us, read some third party Silver.com reviews.

How do I buy from Silver.com?

Our best-in-class e-Commerce website allows customers to easily and quickly place orders, 24/7/365, based on live spot prices from worldwide exchanges. Our pricing updates every few seconds during market hours, so you are always paying the most up-to-date prices for your precious metals products. We also accept orders during off-market hours, allowing customers to lock in pricing on weekends, at night, on holidays, or at any other time throughout the year.

What products does Silver.com sell?

We offer an extremely wide selection of products, including silver and gold coins from all the government mints, silver and gold bars and rounds from a huge selection of private domestic and foreign mints, copper bullion, and specialty products, such as silver bullets, copper bullets, and certified/graded coins. We are always actively sourcing new and interesting products, so check back often.

Where do you get your products, and how do I know they’re real?

Silver.com only sources its products from reputable wholesale distributors and trade desks or directly from the mints themselves. All our products have stamps indicating their purity, weight, and makers mark. Some of our products also contain an assay card or Certificate of Authenticity (COA) for further authentication.

Upon arrival at our vault, we inspect each item carefully for condition and authenticity to make sure our customers are getting only the highest quality products.

What does it mean when a product is listed as a “presale”?

A presale means that we are offering a specified product to our customers before we have it in our vault. This means that either the product has yet to be released or is on a delay from our distributor.

All presale items will have an expected ship date based on our estimate of when we will have the product in stock. Please note, when a presale item is included in your order with other in-stock products, the order will not ship until the presale item is available.

What is a troy ounce?

A troy ounce is the standard measurement used to assess the weight of precious metals. The troy ounce (sometimes abbreviated as “ozt” or “troy oz”) consists of 31.1034768 grams, as opposed to the avoirdupois ounce, which contains only 28 grams. All our precious metal products, including gold, silver, platinum and palladium, are measured in troy ounces. All our base metal products, including copper, are calculated using the avoirdupois ounce (also abbreviated with AVP oz or AVDP oz).

Do you charge sales tax?

We are required to collect sales tax in certain states. You can review your states sales tax policy here. You should always consult with a tax adviser for specific advice in your area.

Do you have a retail store?

We are strictly an online retailer.

Do you have an Affiliate program?

We do not currently have an Affiliate program.

How do I contact Silver.com?

You can contact us at any time through our Contact page. You can also contact us directly by calling 1-888-989-7223.

What are your hours of operation?

You can browse our website and order online 24 hours a day/7 days a week. Additionally, our knowledgeable customer support and sales teams are available from 8:00 a.m. to 6:00 p.m. CST Monday-Friday.

Where are you located?

Our corporate headquarters is located in Dallas, Texas. Our address is: 5930 Royal Lane, Ste. E-151 Dallas, TX 75230.

Do you have an investing guide?

Yes, you can view our comprehensive investing guide here. Always be sure to consult with a financial professional when dealing with any investment.

What forms of payment do you accept?

Customers have a wide range of options when it comes to making payments. These payment options include credit/debit cards, PayPal, paper checks (personal checks, cashier’s checks, money orders, online bill pay, bank drafts, or traveler’s checks), eCheck (ACH), bank wires, bitcoin, bitcoin cash, Ethereum, and Ripple.

Which credit/debit cards do you accept?

We accept payments made with Visa, MasterCard, American Express, and Discover credit/debit cards.

Is there a discount for certain payment methods?

Yes, customers who pay with paper checks, eCheck (ACH), and bank wires are eligible for a 4% discount off the listed credit/debit card or PayPal price. Bitcoin, Ethereum, and Ripple orders are eligible for a 3% discount off credit/debit card or PayPal price

What security measures do you take to protect your customers from credit card fraud?

To protect our customers from any fraudulent credit card activity, all credit/debit card orders are manually screened prior to entering the shipping queue.

How do you protect customers from fraudulent PayPal purchases?

In order to reduce incidents of fraud on PayPal, all customers who opt for this form of payment are required to create and use a “PayPal Verified Shipping Address.” Customers whose shipping addresses have not been verified by PayPal will not be permitted to make their purchases.

Are there minimum and maximum amounts for each payment method?

There is is no minimum amount for payments made with credit/debit cards, Paypal, paper checks, or bitcoin. Bank wires, however, require a minimum payment amount of $2,500 USD. The maximum amounts for each payment method are as follows:

- Credit/debit cards payments have a maximum amount of $25,000.

- PayPal payments have a maximum amount of $10,000.

- Paper Check payments have a maximum amount of $50,000.

- eCheck (ACH) payments have a maximum amount of $100,000.

- Bank Wire payments have a maximum amount of $250,000.

- Bitcoin payments have a maximum amount of $150,000.

- Ethereum payments have a maximum amount of $150,000.

- Ripple payments have a maximum amount of $150,000.

Why do I need to provide my credit/debit card info to make a payment via paper check or bank wire?

We require your credit/debit card information to “lock in” or secure your price. Because the value of different precious metals can increase or decrease several times throughout the day, the price of our merchandise is also constantly changing to reflect those fluctuations. However, locking in your price keeps it from changing during the course of your transaction. Once your price has been locked in, it cannot be changed, regardless of market fluctuation.

This information also serves as a form of “collateral” for your payment until the actual check or bank wire is processed. As long as payments are received within a reasonable time frame, your card will not be charged. Please be advised, should your payment fail to arrive in a timely manner, you may be charged for Market Losses per our Terms of Use.

To whom do I address my check?

You will make your checks payable to “Silver.com.” Customers will be provided with our mailing address for checks once they complete the checkout portion of their transaction. All payments made with paper checks must be received in-full within 10 calendar days. Customers are advised to mail their checks within 1 business day.

How do I send a bank wire?

Once they have completed the checkout portion of their transaction, customers using bank wire payments will immediately be provided with wiring instructions. All bank wire payments MUST be paid in-full within 1 business day.

Please note that all bank wire payments MUST be actual bank wires, which means that the money must be sent from a real bank. (This process may require the customer to visit that bank in person to request the wire.) Payments made using ACH or eCheck do not constitute as bank wires and the use of such payments will result in either the delay or cancellation of your order.

How do I know my payment was received?

Customers whose transactions were made online using credit/debit cards, PayPal, or bitcoin will receive immediate confirmation of payment at the end of the checkout process.

Customers who paid with a paper check, eCheck (ACH), or bank wire will receive an email confirmation of payment once a check has been deposited or a bank wire has been received.

How quickly does it take each payment type to process and enter the shipping queue?

Transactions paid for with credit/debit cards, PayPal, bank wires, or bitcoin are instantly processed and immediately entered into the shipping queue. Please note, first-time payments made with either PayPal or a credit/debit card must undergo manual screening and may take up to one extra business day to process.

Transactions paid for with paper checks and eCheck (ACH) must clear with our Billing Department before entering the shipping queue, which typically takes 4-6 business days from the date of check deposit. Due to increased incidents of checks and money orders being returned, all paper checks must undergo this mandatory 4-6 day clearing process.

Why do you hold cashier’s checks/money orders?

While cashier’s checks and money orders are considered “guaranteed” forms of payment, unfortunately we still receive fake money orders and cashier’s checks. The only way for us to fully verify payment is to wait out the bounce period. All paper checks, regardless if they are personal checks, cashier’s checks, or money orders, require 4-6 business days to clear before entering the shipping queue.

How do I know my personal and financial information is secure?

All personal information is transmitted using secure SSL web pages. These pages are encrypted to ensure no personal financial or identifiable information is made available to anyone other than you, your bank, and the processor. Our 256-bit SSL protection safeguards customer data at all times.

Do you accept cash?

We do not accept cash payments.

What is an eCheck (ACH?)

An eCheck (ACH) is an electronic money transfer between banks that allows money to be pulled from an account to accounts at another bank.

How do I check out using an eCheck (ACH)?

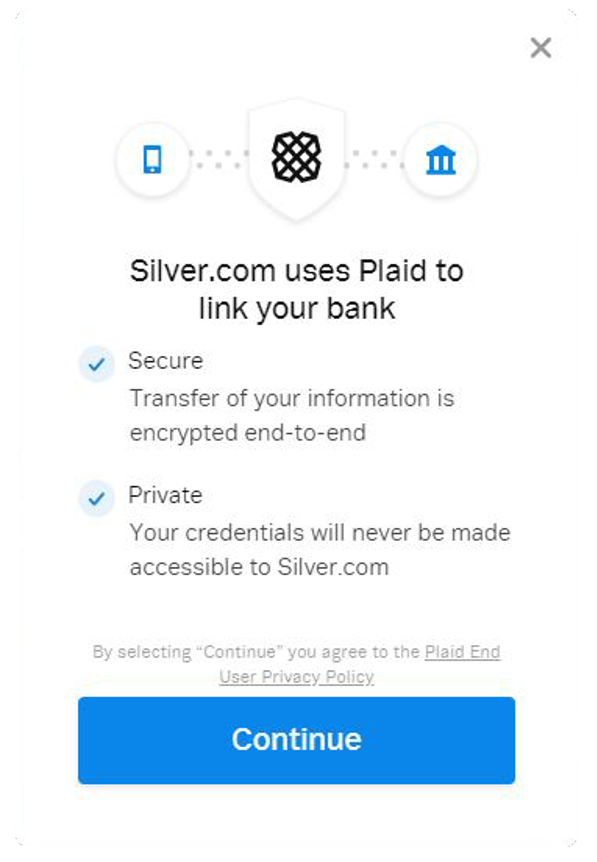

In the cart, the option for eCheck / ACH will appear above the items in your cart. After selecting eCheck / ACH, a gold button to proceed to checkout will appear. Click the button to proceed. Once you are taken to the checkout page, a gold button to log in to your online checking account with appear. Click on the button to proceed. A pop-up will appear:

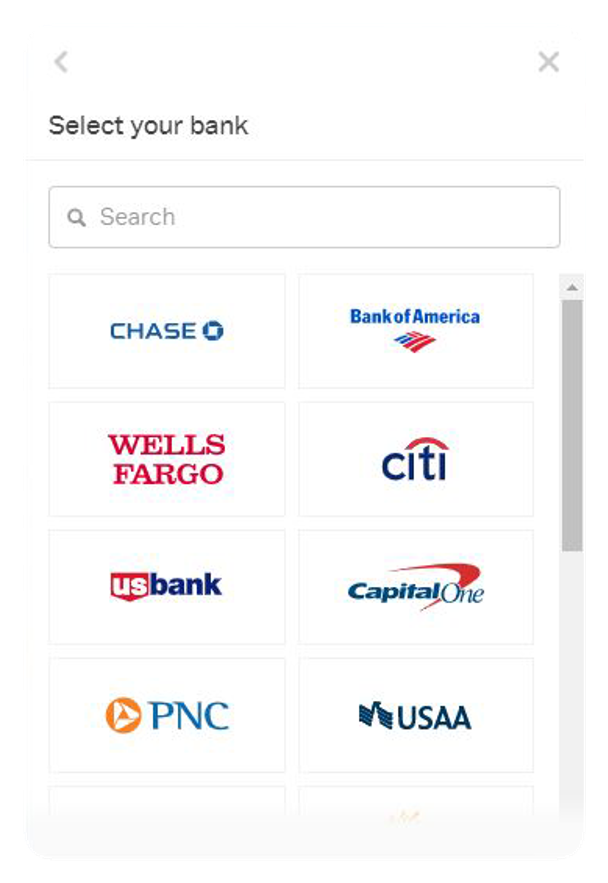

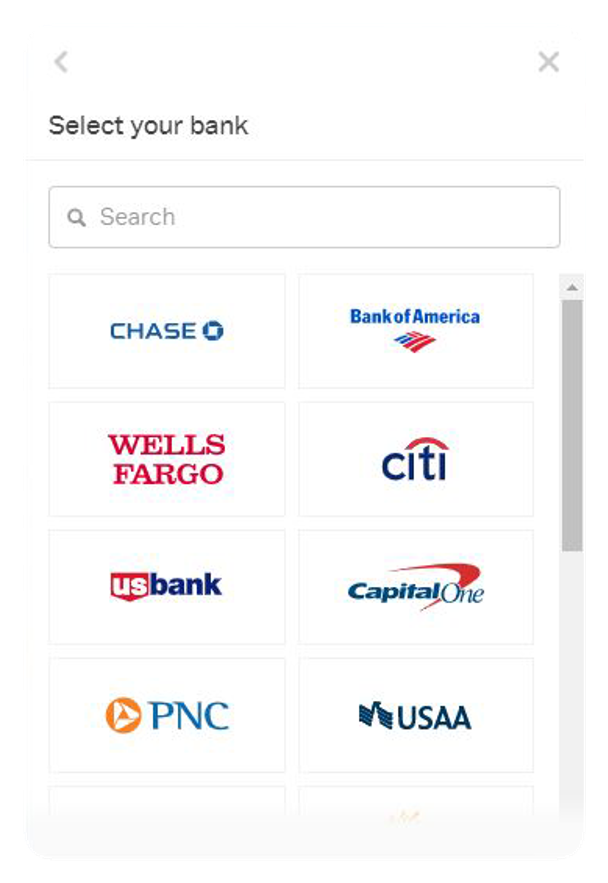

Select or Search for Your Bank

After clicking on continue, a list of banks will appear. If your bank is listed, you can click on it. Otherwise, you can use the search box to locate your bank.

Instant Verification via Secure Bank Log In

Your login credentials and transfer of information are encrypted end-to-end so that it is safe and secure. Silver.ocm does not have access to your login credentials. Once you have selected your bank, you will be asked to log in to your online banking using your credentials. After logging in, all available accounts will be listed. Select the checking account you wish to use. We do not recommend using a savings account for ACH payments since they can cause delays and fees depending on your bank.If your bank supports instant authorization

A confirmation screen will appear and you will be taken back to the checkout to complete your order.If your bank doesn’t support instant authorization

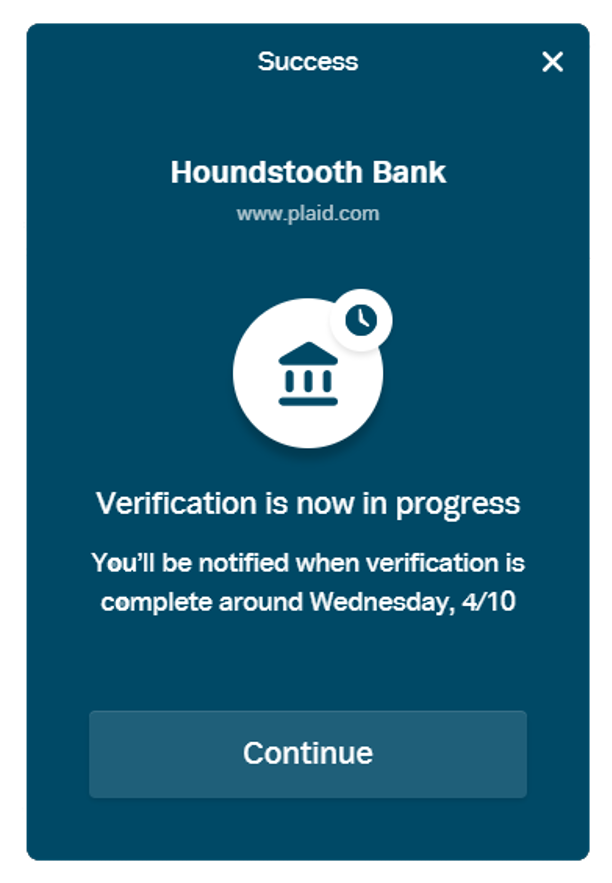

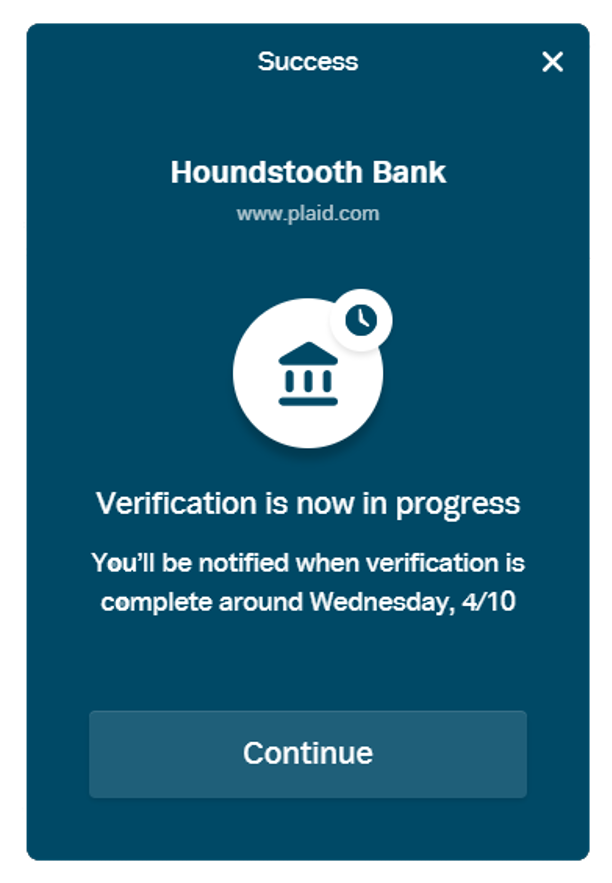

You will be prompted to provide your routing number one time and your account number two times. The first time is to add the account number, the second time is to confirm the account. When the account number has been added a second time, you should see the following screen:

Complete the Checkout

After hitting continue, you will be redirected back to the checkout page to finish placing your order. Your payment will appear at the top of the page as pending. Even though the payment is pending, you still have to complete the checkout for your order to be placed. It can take up to 1 business day for your bank to confirm and complete the verification. We will notify you via email once the verification has been completed and the status of your order has been updated to Paid. If there are any issues during the verification process, you will also be emailed. Your bank account will be tokenized and stored securely for easy future purchases.What is Bitcoin?

Bitcoin is a decentralized digital currency regulated by an immense open-source network of individuals. “Miners” generate bitcoins with computers by solving complicated mathematical algorithms. The miner who solves the algorithm first is rewarded 25 bitcoins. Only 21 million bitcoins will ever be produced. Similar to other commodities, bitcoins are traded once generated. Their rate of exchange changes constantly, and the price can be quite erratic. When you get bitcoins, you store them in your digital “wallet,” which can be kept online or offline. Your wallet acts as your personal bank, and you have complete control of it.*

*We do recommend you supplement this information with your own research as this is an extremely simplified explanation of bitcoin.

How are your prices determined?

Our prices are determined by the current spot prices of gold and silver, in addition to our premiums for each product. Spot price updates happen every second during market hours.

What is spot price?

Spot price is the live, up-to-date price of gold or silver.

When are the spot markets open?

Gold and silver spot markets open Sunday at 6PM EST, and close Friday at 5:15PM EST. Markets are also closed for a short period from 5PM EST to 6PM EST each day, Monday through Thursday. On weekends and during the 5PM to 6PM periods, spot prices remain unchanged. However, customers are welcome to purchase from Silver.com 24/7/365 – even during off-market hours.

Where do you get the current spot price from?

Our up-to-the-minute spot prices are provided by a variety of dependable sources.

What are bid and ask prices?

The bid price is the most recently offered price to buy metal, while the ask price is the most recently offered price to sell metal. When you are buying from Silver.com, you will price off of the ask price. When are you selling your metal, you typically will price off of the bid.

Why do certain products carry higher premiums than other products?

Premiums typically are based on the mint of origin, as well as the complexity and uniqueness of a product. Government-minted coins typically carry the highest premiums; they feature intricate designs, have specific mintages each year, and offer a face value.

Privately minted products typically carry lower premiums as they offer no face value and are produced by a plethora of companies. Smaller products also typically carry higher premiums per ounce than larger products. For instance, a 1 oz silver bar typically carries a higher premium per ounce than a 100 oz silver bar.

Do you add a commission fee to your prices?

No, the prices listed on the website are the actual prices you pay. There are no hidden fees.

Do some payment methods offer discounts?

There is a 4% discount when you pay with a paper check, or bank wire. There is a 3% discount for Bitcoin. The prices shown for each product include the discount unless you select an alternative payment method.

Why are bank wire and paper check prices lower than credit card/PayPal prices?

We are able to offer a discount to customers who pay by bank wire or paper check as those payment methods have lower associated fees than credit card/PayPal transactions.

Why are prices different when I add to cart?

When you add products to your cart, the price displayed will be the default price, which is close to the credit/debit card and PayPal price. Once you select your payment method, you will see the price adjust to the correct price. Please understand the quantity ordered also affects the price for most items.

When are my prices “locked in”?

The prices on all of our products change by the second, around the clock. When you add products to your Cart, the product prices are “fluid” and will continue to change until you advance to Checkout. Once you advance to Checkout, your prices are locked in and displayed on the right side of the checkout form. These prices are held for ten (10) minutes while you complete the checkout process. If you take longer than 10 minutes to complete the checkout process, you will have the option to approve the new, updated prices to finalize your order.

What is your return policy?

Our refund, return, and exchange policy is limited to three (3) business days from the date the item is received. You must notify our Customer Service Department via telephone at 888-989-7223 within three (3) business days from the date that you receive the item and follow the instructions provided to you, at that time. Shipping and handling charges are non-refundable. You are fully responsible for all taxes, as well as return shipping and handling costs.

Silver.com may reject any returned or exchanged item that does not reasonably conform to these terms. In the case of a request for an exchange, Silver.com expressly reserves the right, in its sole and absolute discretion, to find an acceptable replacement or refund your money should an acceptable replacement be unavailable. Returns, refunds and exchanges are subject to our Market Loss Policy. Please note, that a five percent (5%) restocking fee applies to any returned or exchanged items that were purchased via credit/debit card. Any and all market gains on refunds, returns, and exchanges shall belong solely to Silver.com.

Can I modify my order?

As our system is largely automated, we are unable to process order modifications. You would need to cancel your current order, accept the cancellation fees, and place a new order.

Gold/silver have decreased in price. Can I return for a full refund?

Markets are volatile, and we cannot guarantee any specific return on your investments. As such, we cannot offer refunds based on past spot prices. Any returned items would be subject to possible restocking fees, as well as Market Losses in accordance with our Terms of Use.

What if I am unsatisfied with my products?

If you are unsatisfied with your products, please let us know, and we will do our best to accommodate you.

How much do you charge for shipping?

We offer free shipping and insurance on all orders over $3,000. A signature is required on all orders over $1,000. For customers purchasing under $3,000, we offer affordable flat rate shipping at $9.95. Upgrades are available for an additional fee. Prices may vary.

Please note, based on your address a9nd order contents, we will select the most efficient shipping method and carrier at our discretion. Typical carriers/methods for order sizes are listed above, but that is not a guarantee your order will ship as such. Once you add products to your cart and input your delivery address at checkout, you will be able to see your final method of shipping.

We do offer the option to upgrade your shipping to UPS 3-Day Air for an additional charge. No Will Call pickups permitted. UPS 3-Day Air excludes APO addresses, PO Boxes, Alaska, and Hawaii.

How long until my order ships?

All in stock items will ship within 2 business days of cleared payment. The majority of orders typically ship same day of cleared payment.

We put an enormous amount of focus and effort into quick and secure shipping. When you purchase in stock products from Silver.com (noted as In Stock on product pages and in your Cart), you can expect to receive notice of shipment within 2 business days of completed payment (denoted as a processed credit/debit card, PayPal, or bitcoin payment; a fully cleared check; or a received bank wire). The majority of orders typically ship same day of completed payment. See payment clearing timeframes below:

- Credit/Debit Cards – Instant Upon Checkout

- PayPal – Instant Upon Checkout

- Paper Check – 4-6 Business Days from Deposit

- Bank Wire – Instant Upon Receipt of Wire

- Bitcoin – Instant Upon Receipt of Funds

Where will my order ship from?

Most of our orders will ship out of our primary distribution center, which is located in Las Vegas. As a result, our West Coast customers will typically see shorter in-transit times.

Do you ship internationally?

At this time we only ship to USA addresses (including APO & FPO).

Is it safe to ship gold and silver in the mail?

All of our packages are shipped securely in inconspicuous packaging that gives no indication of contents. When mailing valuable precious metals, discretion and protection are key. Your products are securely wrapped in protective packaging, then placed in the shipping parcel along with packing peanuts to prevent the products from shifting during shipping.

Our labels, return address, and packaging do not give any indication of the valuable contents of the package, so you can rest assured that your packages will arrive safe and sound.

Can I change my shipping address after I have placed an order?

We are not able to change any of the shipping details for credit card orders. If you pay by check or bank wire, we are able to change your address, but we ask that you contact us by phone before the item ships. If your item has already shipped, it will be your responsibility to make the proper arrangements with the mail carrier.

Is my package insured?

Every order we ship is covered by our in-house insurance policy. If your order is lost, stolen, or damaged in transit, we will work with the carrier to recover the package or exchange damaged product(s), and failing that, will file an insurance claim in order to provide replacement product(s) or a full refund. Please note, our insurance policy only covers in-transit orders, and coverage ceases upon good delivery of the package (defined as a notice of signature or delivery from the carrier). See our Terms of Use for full details.

How do you wrap your packages?

All our packages are discreetly wrapped and packaged, not to give any indication as to the contents inside.

Will my package require a signature?

Orders under $1,000 will not require a signature upon delivery. Orders over $1,000 will require a signature for delivery.

What if my products are damaged in transit?

If your products are damaged upon arrival, you must notify us within the first three (3) days of the date of delivery. We may require photography or other documentation to process a product exchange. Once we verify the damage, we will provide a return label to send your products back. Upon receipt of the damaged items, we will send your replacement products to you.

How can I check on the status of my order?

You can check the status of your order at any time by logging into your account.

Do you have any minimum order size?

We do not have any order minimums, as we feel precious metals should be available to any investor, small or large.

How do I cancel my order?

Once you have placed an order with Silver.com, you have entered into a binding legal agreement, and cannot cancel the confirmed order without incurring a $35.00 administrative fee and being charged for the corresponding Market Losses.

After Silver.com has shipped the product, the order is final and cannot be canceled. If you refuse shipment the product will be returned to us and you will be charged a $35.00 administrative fee, a standard 5% restocking fee and you will be required to pay for any Market Losses.

What are the differences between bars, rounds, coins, and other types of bullion?

Bars and rounds typically feature generic designs and are produced by private mints. Privately minted bars and rounds are known for their low premiums over spot and wide availability from a multitude of companies. Due to their wide availability from a number of companies, the premium over spot for these bullion pieces is relatively low. (With the exception of “art bars” or intricately designed bars, which carry a higher cost over spot.)

Coins, in comparison, can only be produced at national mints because of their use as functioning pieces of currency. Because of this, they tend to have higher premiums. Their mintage is controlled by the country’s government in most cases, which often restricts them to lesser quantities. Although certain silver rounds look like existing coins, please note these are not legal tender nor do they possess any face value.

Why do coins have higher premiums?

The higher premium on coins, as opposed to other pieces of bullion, can be attributed to several factors. Some collector coins were released as special edition art pieces with only a limited mintage. Others bear a great deal of historical value because they were minted during a significant time. However, the primary reason coins have such a high premium is because they are legal tender pieces of currency and, as such, are minted only by renowned national mints.

What are “certified” coins?

Certified coins reference any coin that has been certified and graded based on their condition by reputable grading agencies, including NGC (Numismatic Guaranty Corporation) and PCGS (Professional Coin Grading Service). Certified coins are placed in plastic slabs and feature serial numbers which can be confirmed with the grading company to affirm authenticity and grade. Besides attesting to a coin’s authenticity, grading companies also provide grades on a scale of 1-70, 70 representing a perfect mint-state coin. Graded coins with 67 or higher grades typically will carry a higher premium due to rarity and condition.

What is junk silver?

Junk silver is a term that refers to any silver coin in which the numismatic or collectible value does not surpass its silver composition value. Most junk coins were minted prior to 1965 and possess a silver purity level of 90%. They are often sold in rolls or sets based on face value. The term “junk silver” can be a bit misleading since most of these coins tend to be in fair condition.

What is shipwreck silver?

Shipwreck silver is any silver bullion piece which has been recovered from a sunken vessel or boat and resold to the public.

What are bullion bullets?

Precious & base metal bullets, such as silver and copper bullets, are a form of bullion which have been modeled after real life ammunition cartridges. They are typically minted from .999 pure metal and can range in size from 1 to 100 ounces. Currently, there are only a few mints that produce them, but with the increasing popularity of these pieces among investors, gun enthusiasts and war veterans, these numbers are certain to increase over the next couple of years. Please be advised that while most of the silver bullets are based on actual pieces of ammunition, they are not intended to be fired or loaded into any firearms or weapons.

What are silver dollars?

Silver dollars originally served as the coin version of the paper dollar bill. They were produced as a preventive measure against counterfeit paper currency. Although the term “silver dollar” is often interpreted as any silver-colored dollar coin, genuine silver dollars were produced prior to the cessation of silver coinage in 1965. These dollar coins possess a silver content of 90%.

Should I buy gold, silver, or both?

We recommend investing in a diverse set of products, including silver, gold, copper, and more. Although precious metals prices typically move in tandem, it never hurts to have exposure to multiple metals, especially when we see movement in the gold/silver ratio. Since we offer several smaller-sized gold products, even investors on a tight budget can purchase both gold and silver for their portfolio from Silver.com.

Do you report my purchases to the government?

In almost all instances, we do not report your purchases to the government. However, we do report cash payments over $10,000 on a single transaction or series of related transactions as required by law. Cash is defined as money orders or cashier’s checks less than $10,000 each. Related transactions are defined as multiple transactions within a 24-hour time span with a combined total in excess of $10,000. For more information on reporting requirements, please contact us at 1-888-989-7223, help@silver.com, or on Live Chat.

Are there any taxes on precious metals?

There can be taxes on precious metals, but this will depend on the state or city in which you live. The value of the purchase may also be a factor as to whether or not an item may be taxed. The most common form of tax will be a sales tax. You can find the sales tax policy for your state here.

What is a precious metals IRA?

A precious metal IRA allows individuals to make investments in precious metals, such as gold, silver, or platinum within their Individual Retirement Account.

Why do I a need a precious metals IRA?

Precious metals IRAs offer individuals the opportunity to diversify their investment portfolios and further contribute to their current retirement and 401k plans. There are also many tax related benefits, such as tax-deferred and tax-free growth.

How do I set up a precious metals IRA?

Setting up a precious metals IRA is a simple, three-step process. Simply select one of our partner IRA custodians or a custodian of your choice and contact them about opening a self-directed IRA. Let the custodian know you are interested in purchasing IRA-approved precious metal products, and they will help you deposit funds into your account. Once your account is funded, you are ready to purchase IRA-approved metals from Silver.com. Be sure to visit our IRA page to learn more about precious metals IRAs.

How do I fund my account?

Simply inform your custodian that you wish to transfer or bank wire a certain amount from your existing IRA or 401k accounts to your new one. Your custodian can further guide you through this process. Once you and your custodian come to an agreement, your custodian will inform our company of your contribution amount, and you can begin ordering from us.

What products are IRA eligible and do you offer any of them?

In order to qualify as an IRA eligible product, silver products must possess at least 99.9% purity level. The following silver products have been approved as IRA contributions and are currently available on our website:

- American Silver Eagle coins and products

- America the Beautiful coins and products

- Canadian Silver Maple Leaf coins

- Austrian Silver Philharmonic coins

- Any .999 fine silver bars and rounds produced by NYMEX- or COMEX-approved/affiliated suppliers and reputable producers, such as Johnson Matthey and Engelhard.

- American Gold Eagle coins and products

- Gold Buffalo coins and products

- Canadian Gold Maple Leaf coins

- Austrian Gold Philharmonic coins

- 24k (.999+ fine) gold bars or coins produced by NYMEX- or COMEX- approved/affiliated suppliers like PAMP Suisse and Credit Suisse.

How much can I contribute to an IRA annually?

Age is the primary factor in determining how much an individual can contribute to their account annually. Individuals younger than 50 years of age are limited to a maximum of $5,000. Individuals older than 50 have a maximum contribution limit of $6,000.

You should also be aware, all contributions to IRA accounts are tax-deductible, meaning that any money you invest into your IRA can be deducted against your income taxes. Contributions exceeding those amounts will not be eligible for those tax deductions.

Are there any fees involved in precious metals investing?

There will most likely be an initial fee to set up an IRA, along with an annual fee. You will also be required to pay a storage fee to whichever depository with which you choose to work. Of course, there will also be the price of the precious metal products themselves. Fortunately, these initial and maintenance costs will pay for themselves in the long run.

Are there any restrictions to what I can do with my contributions?

There are not any restrictions to what you can do with your contributions. Once you have deposited money into your IRA, it is completely up to you whether you wish to buy, sell, or trade. While these actions will not warrant any tax liabilities, any withdrawals made from the IRA account will result in the standard income taxes charges on the withdrawn balance. It is typically 10% of the withdrawn amount. Fortunately, these penalties are no longer applicable once you reach the age of 60.

Why can’t my investments be delivered directly to me?

Unfortunately, IRA policies state that investors are not allowed to take possession of their contributions, nor can they be involved in its delivery. All products must be shipped directly to a separate third-party depository, where they can be physically stored away. In addition, the address of your chosen depository must be provided in order for you to complete your transaction. Once the depository receives your contribution, it will notify both you and your custodian of its arrival.

Assay

A test given to items containing metals which determines their metal type, composition, and purity. Some precious metals, such as gold bars, are offered with assay cards. This states the bar’s metal composition, weight, and purity.

Face Value

A legal tender value assigned to a bullion coin by its issuing government.

Junk Silver

This refers to old circulating coinage which contains 90%, 40%, or 35% silver. Though the name suggests the coins are “junk,” they are actually a viable option for many investors due to their high purity. They are also quite collectible.

Mintage

The amount of coins produced in a year or from a specific series.

Mint

When talking about coins, a mint is the place where a country’s currency is produced under the control of its government. With precious metals, there are also “private mints” which are not government run. Private mints produce bullion rounds, bars, or medallions.

Obverse

The front side of a coin.

Precious Metal

A classification of metals which are rare or have a high economic value. The most common precious metals are gold, silver, and platinum.

Premiums

This refers to the fixed dollar amount or percentage over the current spot price that a precious metal product carries. Premiums are often associated with production and distribution costs.

Proof

This refers to a coin which has been struck using a special minting procedure that gives the coin a mirror-like finish. These types of coins are usually produced for collectors.

Purity

The percentage of metal contained in a piece of bullion.

Refinery

When talking about precious metals, a refinery is an industrial facility that “refines,” or reduces, scrap metal and raw materials down to their purest form.

Reverse

The back side of a coin

Spot Price

The current price of a precious metal based off of a combination of different markets including futures, over the counter, and world markets. Precious metal spot prices are always calculated by the troy ounce.

Troy Ounce

A unit of measure used to gauge the weight of precious metals. A troy ounce consists of 31.1034768 grams.

AU

An abbreviation for “Almost Uncirculated” that refers to coins that have seen slight wear and circulation with around 95% of their original design present. Coins considered AU show most of their original luster.

BU

An abbreviation for the term “Brilliant Uncirculated.” This term applies to a coin which has never before been circulated and, therefore, shows very little signs of wear. Alternate terms are “Mint State” or “Uncirculated.”

Fine

This is a term used when evaluating the condition of a coin. It is considered to be one step up from VG. Coins considered to be in Fine condition still show major signs of wear with up to half of the original design rubbed smooth.

G

An abbreviation for “Good” that refers to coins which have been heavily worn, and though their original design is visible, only around 10% of it remains.

MS

An abbreviation for the term “Mint State” that refers to coins in superior condition. The MS grades are often assigned to coins by professional grading companies, such as the PCGS or NGC and range from MS60-MS70; 70 being the best condition.

VF

An abbreviation for “Very Fine” that refers to coins that have been circulated and worn but still have around 75% of their original design intact.

VG

An abbreviation for “Very Good.” This is a term used when evaluating the condition of a coin. Though the name sounds like it would represent a stunning coin, the truth is VG coins are considered to show signs of wear throughout, though the letters may still be legible.

XF

An abbreviation for “Extra Fine” that refers to coins which have only seen light wear. Dings and scratches will only be present on their highest points with around 90% of their original design in tact.