Collectible / Gold and Silver Bullion State Sales Taxes

Laws and Regulations by State

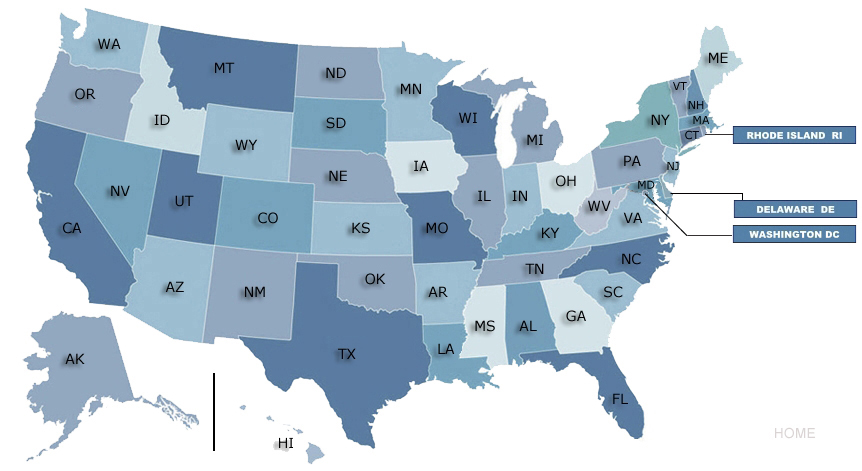

Click on your state in the map below:

Purchasing Gold and Silver Bullion in the United States at Silver.com

The online purchase of gold and silver bullion products at Silver.com now requires the collection of local sales tax in some states. Silver.com is obligated to comply with these changes in sales tax collection, and in an effort to make things easier for our shoppers we’ve developed a helpful directory for you to research your local sales tax rates. Before you complete a sale, you can use the directory to research sales tax rates by state so you have a better idea of the regulations before you buy. It’s important to note that the sales tax is decided by the physical address we’re shipping to. If your gold and silver are stored in a vault or other facility in a different state, please be sure to look into the sales tax rate for the state where your bullion is stored and not the state you live in.

States Where We Currently Collect Sales Tax

We presently charge sales tax on the following states in some form.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming